FE-AP is an electronic invoice in public administration portal that processes and receives electronic invoices in Portugal. The portal’s implementation is overseen by eSPap, a government authority that sets up and maintains the public procurement e-invoicing system.

Electronic invoicing was introduced in Portugal and other European countries to reduce fake tax credit and improve transparency in invoicing. This digital solution helps public sector companies and contractors to receive and process electronic invoices that comply with European standards.

When you issue, transmit and receive an invoice in a structured, electronic format, it is considered an electronic invoice (e-invoice). There are compliance dates and rules to follow surrounding e-invoices in Portugal. It is crucial to follow all standards and send and process invoices correctly to avoid legal consequences.

Are you wondering how to send e-invoices in the Public Administration sector in Portugal?

This article will focus on what FE-AP is and who governs e-invoicing in Portugal. You will also find out whether e-invoicing is mandatory in Portugal and the requirements for using FE-AP.

What is FE-AP?

FE-AP (Fatura Eletrónica na Administração Pública) is the Electronic Invoice in Public Administration portal that acts as the Gateway of the State.

The portal is a General Point of Entry to process and receive electronic invoices in Portugal and monitors the following processes:

- Receiving

- Validating

- Archiving

- Verifying

- Processing in digital formats accepted by the European Commission such as UBL (CUIS-PT)

FE-AP allows suppliers and public entities to transfer and receive e-invoices through a secure online connection(web-service); hence you can’t send through e-mail. Additionally, the B2AP portal supports suppliers to monitor e-invoice status sent to FE-AP. The B2AP portal is responsible for supplier relationships with the Public Administration.

The public bodies that have to work with eSPap’s portal include the following:

- Public Institutes such as ISS, IAPMEI, IPDJ, eSPap

- Direct State Administration Bodies like Regional Directorates, General Secretariats, DGEstE, ASAE, IGF, AT, etc.

Main features of the FE-AP solution:

- The FE-AP solution was developed for Public Administration processes (Public Shared Services)

- The portal is user-friendly and allows operations in a simple and agile way

- FE-AP ensures the speed and quality of projects

- B2AP portal that provides dematerialized dialogue with suppliers

- Support team with skills and experience to advise suppliers and public administration.

Here are the benefits of using the FE-AP solution:

- High-quality merging of data in the e-invoice in the public entities’ accounting systems

- Automatically verifies and supports digital transformation and dematerialization

- Improved public treasury management since they can monitor invoices and create cash flow plans.

Read more: 5 Advantages of Using an E-invoicing Portal

Who governs e-invoicing in Portugal?

ESPap or “Entidade de Serviços Partilhados da Administração Pública I.P.” is an umbrella organization that was created by the Ministry of Finance. The work of this government authority is to set up and maintain the public procurement invoicing system. ESPap also publishes technical and functional requirements.

ESPap sees over the implementation of FE-AP. The authority has been tasked with establishing technical and functional requirements to support the following:

- Creating support tools for the covered entities

- Execution of electronic invoicing

- Supply a solution for receiving and processing e-invoices.

Read more: Understanding Electronic Invoicing in Public Procurement Processes in Portugal

Is electronic invoicing mandatory in Portugal?

No. Electronic invoicing is not mandatory in Portugal. It is only mandatory for the B2G (Business to Government) sector, not B2C (Business to Consumer) or B2B (Business to Business) sectors.

B2G e-invoices are mandatory for the following:

- Large enterprises since January 1st, 2021

- Medium and small-sized enterprises since July 1st, 2021

- Microenterprises and public entities since January 2022

Look at how the European Commission defines small, medium-sized and large enterprises:

- Microenterprises are ones with fewer than 10 employees and annual balance sheet totals or/and turnover of less than EUR 2 million.

- Small enterprises have less than 50 employees and EUR 10 million annual balance sheet total or/and turnover.

- Medium-sized enterprises have fewer than 250 workers and EUR 40 million in their annual balance sheet total. They also have an annual turnover of less than EUR 50 million.

- Large enterprises have less than 250 employees, an annual turnover of less than EUR 50 million, and an annual balance sheet total of less than EUR 43 million.

E-invoicing is also not compulsory for export transactions in Portugal. The invoices for export can be in .pdf or paper format.

Read more: Request our free E-invoicing Compliance Timeline

What are the requirements for using FE-AP?

Here are four requirements for using FE-AP

1. ESPap only accepts e-invoices in two formats:

- UBL 2.1 “CIUS-PT.”

- CEFACT “CIUS-PT.”

2. E-invoices must include a QR code

In 2022, it is a must for all invoices (both electronic and printed) to have QR CODE. The QR code should be 30*30mm and on the first page of the invoice.

The QR code on e-invoices was introduced by the Portuguese Government in January 2021 but was postponed due to Coronavirus.

3. E-invoices must include an ATCUD code as of January 1st, 2023

The ATCUD code is a unique number that validates and confirms your identity. Implementation of the AUTCUD code was to be mandatory from January 2022. However, including the code is voluntary until 2023 because the budget keeps suspending the requirement.

You need an AT (Autoridade Tributária e Aduanera) certified software solution to include the ATCUD and the QR code.

4. E-invoice must have a digital signature as of July 1st, 2022

Companies must validate their e-invoices with a digital signature.

Additionally, live invoice requirements will include details of the following:

- Date of invoice

- Government contractor details

- Details of goods or services supplied

- Contract and delivery term details

- Supplier details and VAT identification

- Payment instructions

- Net, VAT, and gross value of the invoice.

Read more: Portuguese Invoice QR and ATCUD Codes Mandatory

What is the process of e-invoicing for public administrations in Portugal?

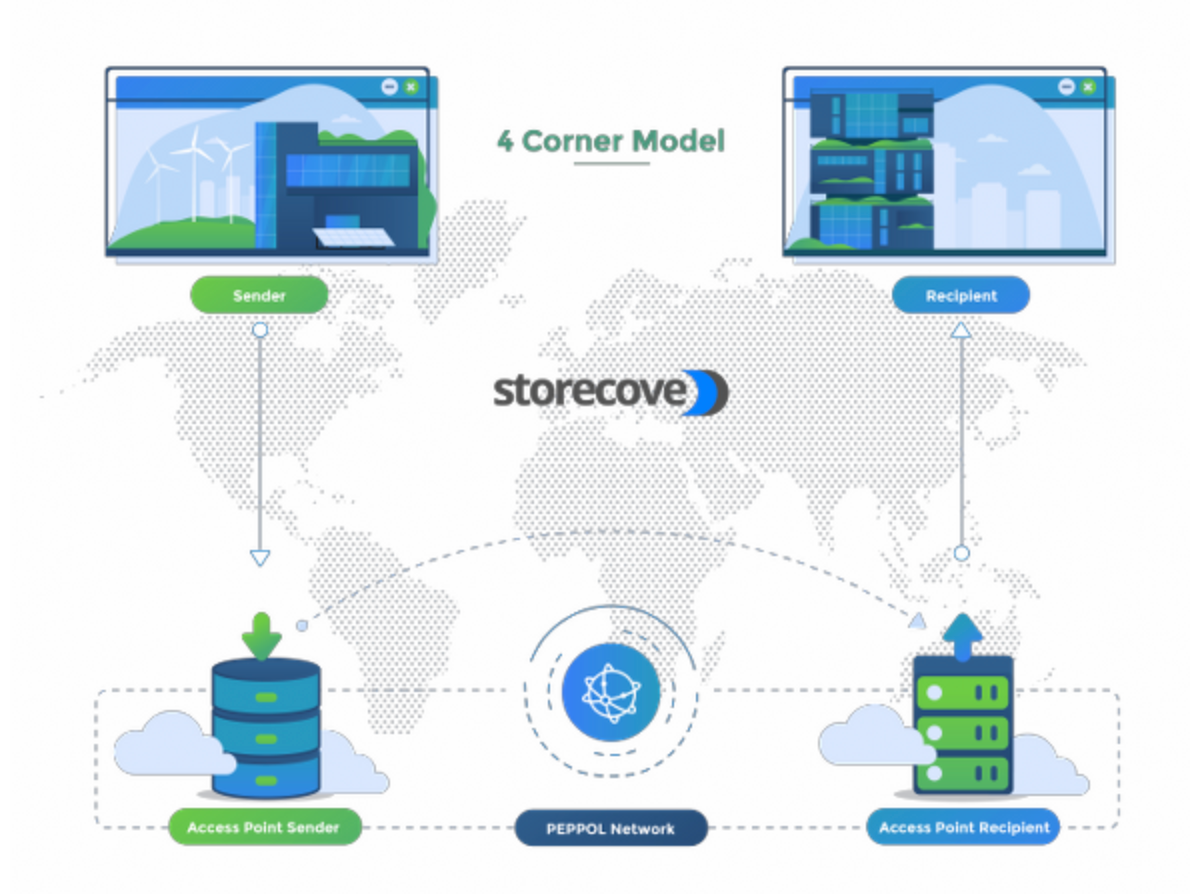

- Choose an e-invoicing software or a supplier of e-invoicing services such as Storecove.

- Ensure the e-invoicing service provider is aligned with VAT requirements and cross-border e-invoicing. They must be a certified e-invoicing application by the Portugues tax authority.

- The e-invoicing service provider facilitates issuing and receiving e-invoices according to eSPap requirements for public administrations and suppliers.

- Submit the invoices through eSPap’s portal (FE-AP), which will be transferred through a secure online connection (web service).

E-invoicing made easy with Storecove

The portal is a General Point of Entry to process and receive electronic invoices. FE-AP allows suppliers and entities to transfer and receive e-invoices through a secure online connection (web-service), meaning you can’t send through e-mail.

Electronic invoicing is not mandatory in Portugal. It is only compulsory for the B2G (Business to Government) sector, not B2C (Business to Consumer) or B2B (Business to Business) sectors.

A great e-invoicing solution that will help you with invoice processing is Storecove.

Storecove helps you connect to e-invoicing networks. We support e-invoicing formats and ensure you comply with all Portuguese e-invoicing regulations. Here are ways we can help you:

- Comply with e-invoicing regulations: Our connections help you automatically comply with the latest e-invoicing standards in your country. We help you connect to all; hence no need to buy multiple subscriptions from different suppliers.

- Connect to all international networks: Our API lets you connect to international e-invoicing networks such as SDI, Peppol, Tungsten, NAV Dynamics, SAP Ariba, etc. If your old systems can connect to other networks, Storecove is here to help.

- Adhere to relevant tax authorities: You don’t need to keep up with e-invoicing requirements. Storecove helps you adhere to all tax authorities like AT(Autoridade Tributária e Aduanera) in Portugal.

- Save money on e-invoicing prices: E-invoicing is cheaper than traditional e-invoicing. Sending invoice costs reduce by 59% while receiving costs reduce by 64%.

Book a demo with our team to get started.

Read more: ViDA Compliance Guide: How to Prepare for the Initiative

Want more information about FE-AP?

Contact us for more information or schedule a consult with one of our e-invoicing experts.

Read also:

Comments